About Federated Funding Partners Legit

Table of ContentsThe smart Trick of Federated Funding Partners Bbb That Nobody is Talking AboutThe Ultimate Guide To Federated Funding PartnersLittle Known Questions About Federated Funding Partners Reviews.Facts About Federated Funding Partners Reviews Uncovered

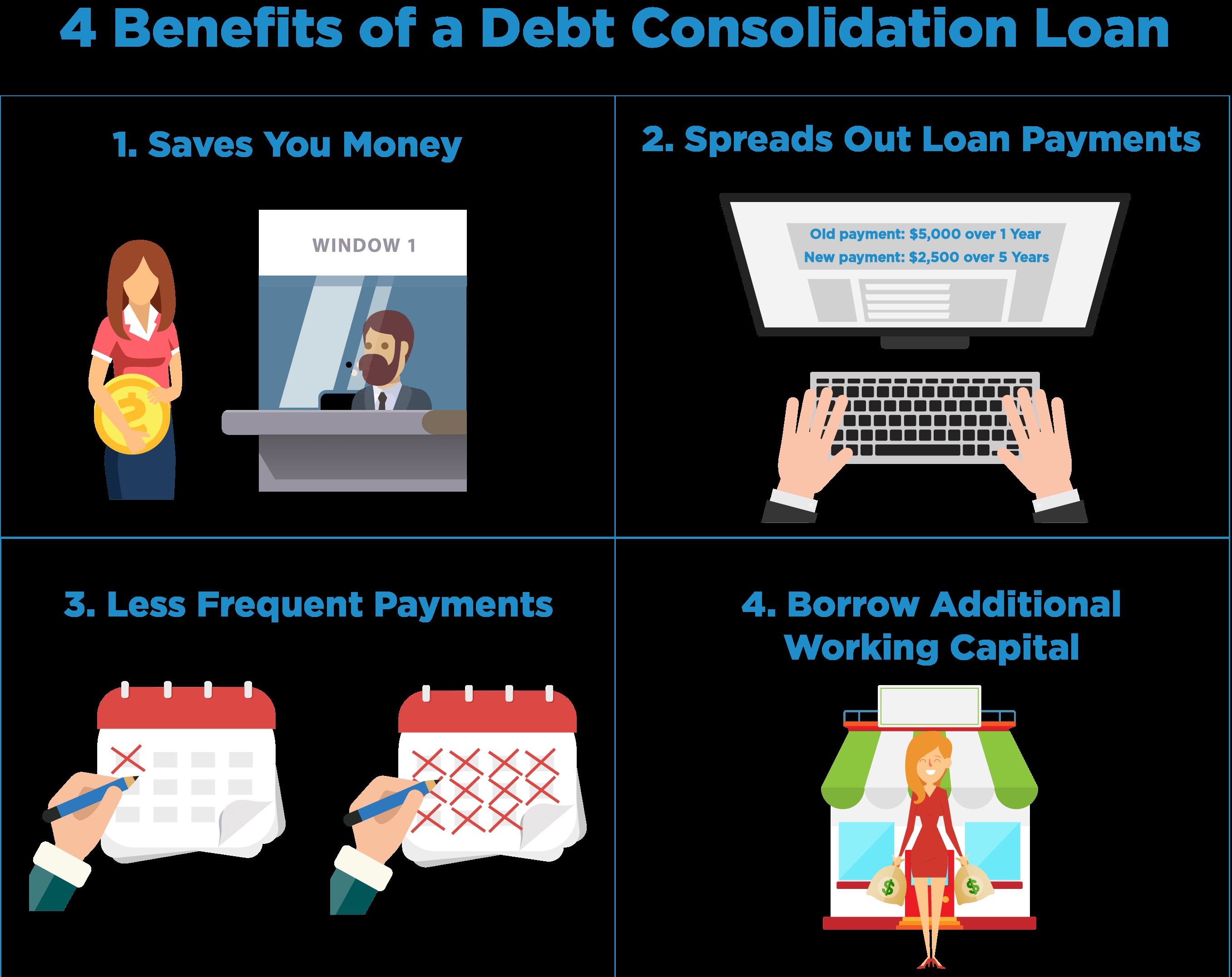

This enables you to make one regular monthly payment for every one of your debts. The goals of any type of form of financial obligation consolidation are to lower the quantity of interest you pay on your financial debt and also, ideally, decrease your monthly payments. Pursuing financial obligation loan consolidation is helpful for those strapped with numerous high-interest financial obligations, such as charge card, a vehicle loan, and pupil financings (federated funding partners legit).

00% APR. Rather than making three regular monthly payments, you can combine those three financial obligations into one solitary financial debt. This might be done by taking out a financial debt combination lending and also utilizing that obtained money to settle the balances of your charge card as well as pupil funding. After that you will make month-to-month settlements towards your financial obligation combination funding till the lending term ends.

The 30-Second Trick For Federated Funding Partners

This may assist lower your regular monthly settlement. You additionally wish to make sure you do not get a longer term than what you already had, to avoid paying a lot more in interest gradually. When you're approved for a new financing or signed up in a financial debt management strategy, you can start making your regular monthly repayments until every one of your debts are paid for.

Financial Debt Combination Options There are numerous means to set about debt loan consolidation, but one of the most usual kinds include a debt loan consolidation individual car loan, debt management strategy, equilibrium transfer, or student financing program. Debt Loan Consolidation Personal Car Loan With a personal loan (secured or unsafe), you get the obtained money in one lump sum with a set rate of interest. federated funding partners reviews.

When you get a combination finance, the lender evaluates your payment background, credit score ratings, and various other variables to determine whether you're likely to be able to pay back your financing. The lower line, you need to be creditworthy to get accepted for a financial debt consolidation financing. Take a closer take a look at debt consolidation loans.

Here are a couple of variables to think about: A 0% yearly portion rate (APR) commonly has a limited time frame of 12-18 months. After that, basic interest prices might apply if you still have an equilibrium.

Federated Funding Partners - Truths

This technique will align finest with your goals if you prepare on repaying your equilibrium before the 0% initial APR duration finishes. Discover the appropriate charge card for you. Home Equity You can also settle debt with a residence equity loan or home equity credit line (HELOC). These alternatives typically have low-interest prices.

Get extra info regarding news residence equity. Trainee Financing Program For the 44. 7 million Americans with trainee loan debt, there are ways to settle trainee lendings. You can consolidate federal finances through the federal government with useful content choices such as the Federal Direct Loan Program. You may likewise have the ability to settle your pupil fundings via your lending institution, financial institution, or a specialized trainee car loan lending institution.

A debt monitoring business or credit report therapy company will combine your debts into one monthly settlement and also coordinate with your financial institutions to work out a lower rates of interest. You'll after that make your settlements to the firm or company, which will certainly assign your money to your lenders. The end goal is for you to pay down your debt in 3-5 years.

As an example, if your consolidation loan has a reduced rate of interest advice than your original lending, you'll end up with a lower month-to-month repayment quantity. Or if you choose a shorter term when you consolidate, you can repay your finance much faster. Other advantages consist of one regular monthly repayment instead of numerous, and also the capability to choose a set rate so you never need to fret regarding price walks.

The Best Guide To Federated Funding Partners Legit

You might be prepared to explore financial debt combination if: You're having trouble staying up to date with your monthly settlements You're paying for financial obligation on five or even more credit cards You have actually maxed out your bank card or are close to your credit rating restriction You have a high enough credit report to get a lower finance rate You agree to alter your spending habits, suggesting you won't rack up even more debt When Financial obligation Consolidation Does Not Make Feeling While debt consolidation has numerous benefits, it could not be your best option if: You have a percentage of financial obligation You're considering You require to boost your credit history because you most likely will not receive a reduced rate of interest You don't intend to transform your financial practices, which indicates you can wind up back in the red How Debt Debt consolidation Influences Your Credit Score Getting any car loan results in a tough credit rating inquiry, which can briefly reduce your credit history by approximately 5 factors.

With the ideal strategy for you, financial debt consolidation might aid you pursue removing your financial debt and also that economic stress and anxiety. Obtain a more detailed consider just how settling can aid you. federated funding partners bbb.

We utilize cookies to secure and customize your web use. By proceeding to utilize this site we assume you're okay with our notice.